2022: Review and Investment Outlook

Key developments in bitcoin and what to look for in the year ahead.

Welcome to the Dallas Bitcoin Standard! The goal of this publication is to educate on bitcoin; this issue, to provide a high level overview of the key developments that happened in 2022. If you are already holding bitcoin or interested in allocating capital to bitcoin this is the issue for you!

Despite a tough year in the bitcoin market, we have a lot to look forward to. First, bitcoin isn’t dead. All jokes aside, bitcoin just celebrated its 14th birthday. That’s 14 uninterrupted years it has provided an immutable, censorship-resistant, and decentralized ledger for anyone in the world to build upon.

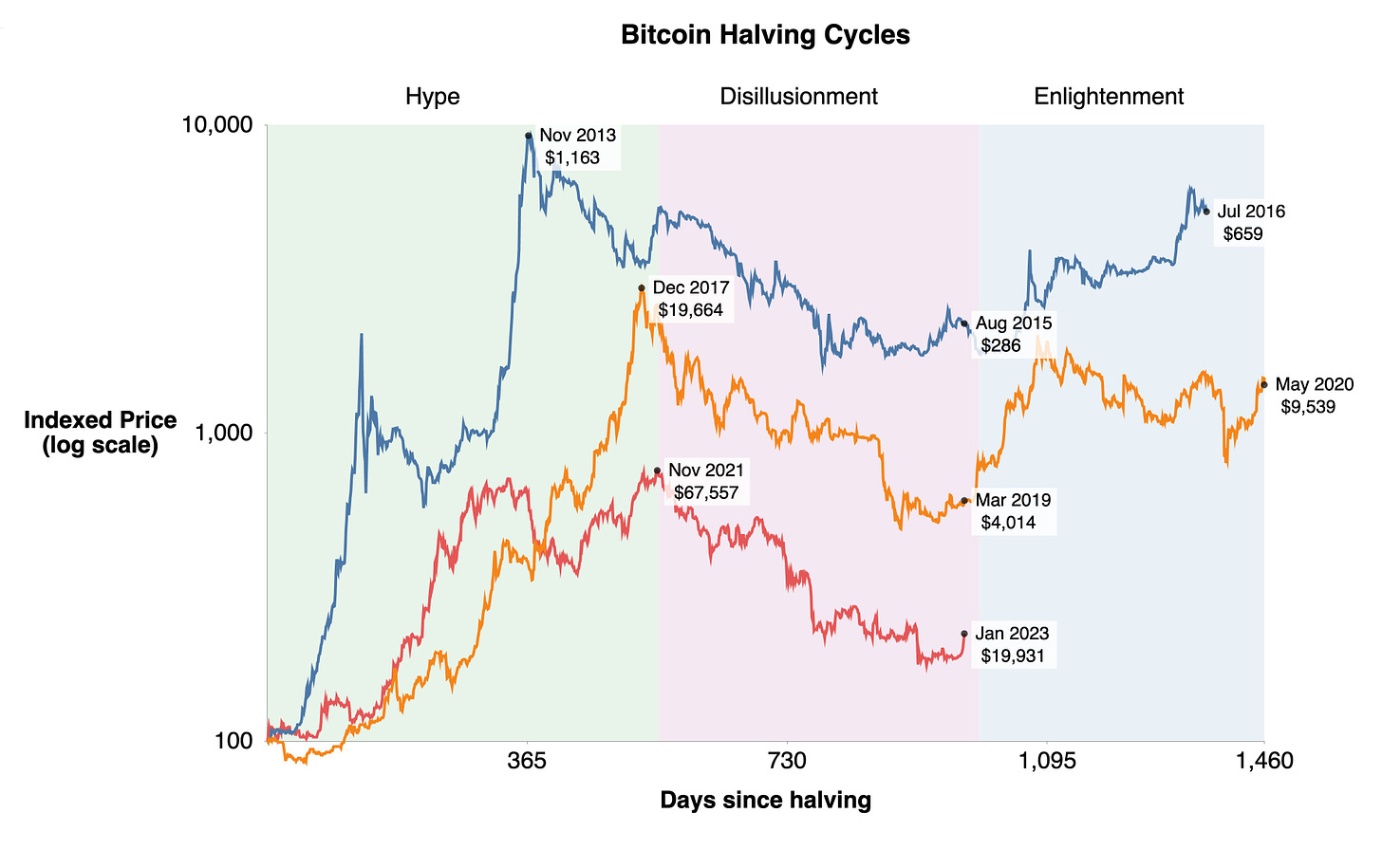

The Bitcoin network functions in cycles, from price to petahash. Though each cycle is unique, we can use them to form a framework of understanding where we are today. Having, what Bill Bradley called, “a sense of where you are,” in the bitcoin cycle is critical to building the level of conviction necessary to preserve a bitcoin position from its innate and inevitable volatility.

Where we are

I believe we are at the point in the current market cycle where most people give up. Maintaining a position during disillusionment is tough. After awhile, bitcoin loses its lust. But history tells us that those who buy and hold through this phase will be rewarded. In fact, this next year should present one of the best risk-adjusted entry points for an initial bitcoin position.

I really like these next few charts that NYDIG put out in their Q4 report. They provide an excellent framework for us to derive a sense of where we are in this bitcoin cycle.

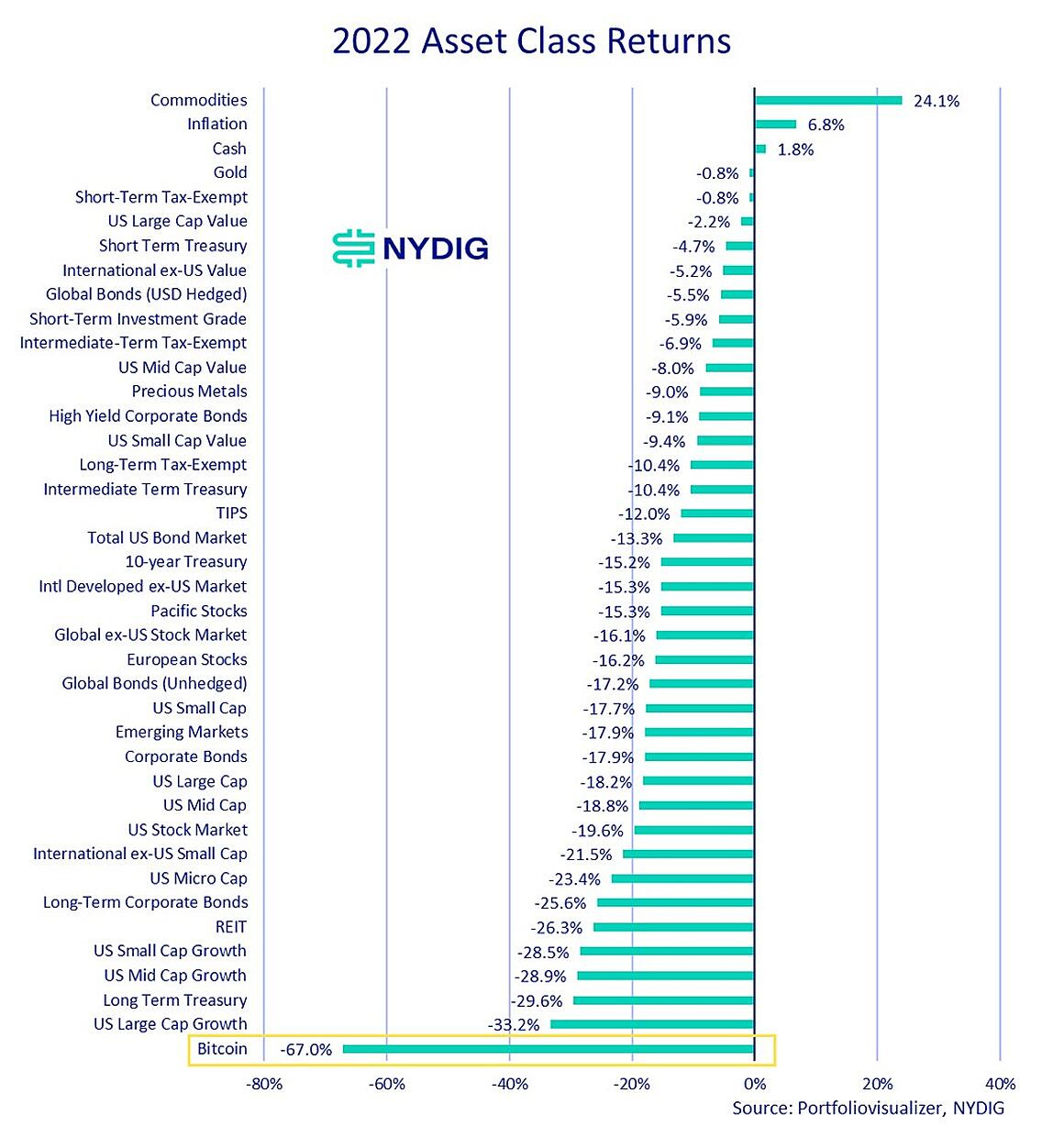

First, bitcoin's annual return compared to every other financial asset.

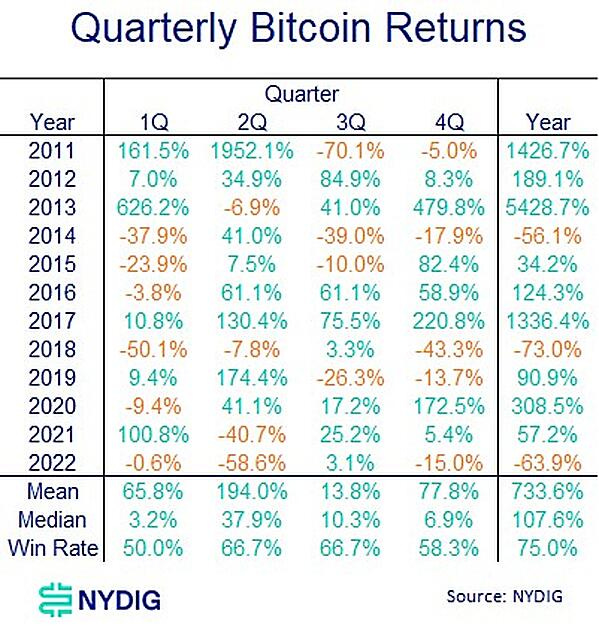

Nasty, no point in sugarcoating it. Nothing was safe in 2022, stocks and bonds had their worst combined year in over 100 years; the 60/40 portfolio since modern portfolio theory was invented. Bitcoin, down 75% from its all-time high in November of 2021, had its first down year since 2018. If there is a silver-lining for bitcoin, it is that the quarterly returns in 2022 look a lot like 2014 and 2018, which each marked troughs in their respective cycles.

Bitcoin has performed well, up 62% on average, in the year following a down year, and especially well when also preceding a halving year (~91% in 2019). Bitcoin’s halving event is one of bitcoins most important features, and has historically been the primary catalyst for bull markets. Investors should keep this in mind considering the next halving is slated to occur in March of 2024.

The chart below provides an exceptional framework for bitcoin cycles indexed to the halving event.

With the hot start we’ve had to 2023, this chart holds true today and is a compelling picture of what we can expect through the rest of the year. Although it is impossible to forecast with certainty where we will be a year from now, I’m confident that we will be higher than we are today. Bitcoin and its track record has given us no meaningful reason to believe that “this time is different.” With history as our guide, this year will be a phenomenal year to buy bitcoin in the long arc of time horizons.

Bitcoin Network: Key Developments in 2022

Not Your Keys, Not Your Cheese!

Events that transpired over 2022 were a sobering reminder of the importance of self-custody. The timeless adage “Not your keys, not your coins,” turned out to be a priceless lesson for seasoned bitcoin holders and a costly one for new entrants.

Following the combustion of LUNA and Three Arrows Capital, centralized crypto lenders fell like dominos. One-by-one companies like Celcius, Voyager, and BlockFi froze withdrawals and filed for Chapter 11 bankruptcy, putting their customers personal information and bitcoin holdings on a pedestal for the world to see. The market turmoil snowballed through the second half of the year, ending notoriously with Sam Bankman-Fried being arrested amid the downfall of the second largest exchange, FTX, in the world resulting in tens of thousands of investors being cutoff from their bitcoin that wasn’t actually there anyways.

It’s worth noting that bitcoin is not at fault for anything that happened. Nothing fundamentally changed with bitcoin or its ability to enforce a fixed supply of 21 million units on a decentralized basis. Instead, centralized businesses got greedy and made mistakes around bitcoin due to their misunderstanding of it, primarily through synthetic and cryptic financial product offerings like “staking-as-a-service.”

Bitcoin, being is a digital bearer asset, offers us the ability to take full custody of it. This is arguably bitcoins most important feature and why many people choose to invest in bitcoin in the first place.

Of course there is responsibility that comes with taking full control of bitcoin. Fortunately, their are a myriad of different ways to do it and companies out there that help people do it (insert shameless plug for my employer Unchained Capital). Investors that didn’t take the time to understand the tradeoffs between self-custody and trusting a third-party to custody their coin in 2022 learned the risks associated with the latter the hard way.

Bitcoin Mining

Following a two-year renaissance period between 2020-2021, Bitcoin miners faced a brutal year capped off by an exceptionally cold winter. Like the centralized lending companies that went belly up in 2022, a majority of mining companies were caught offsides and overleveraged when bitcoin price took its turn. No miner was immune to the death by a thousand cuts that has plagued the mining industry for cycles before.

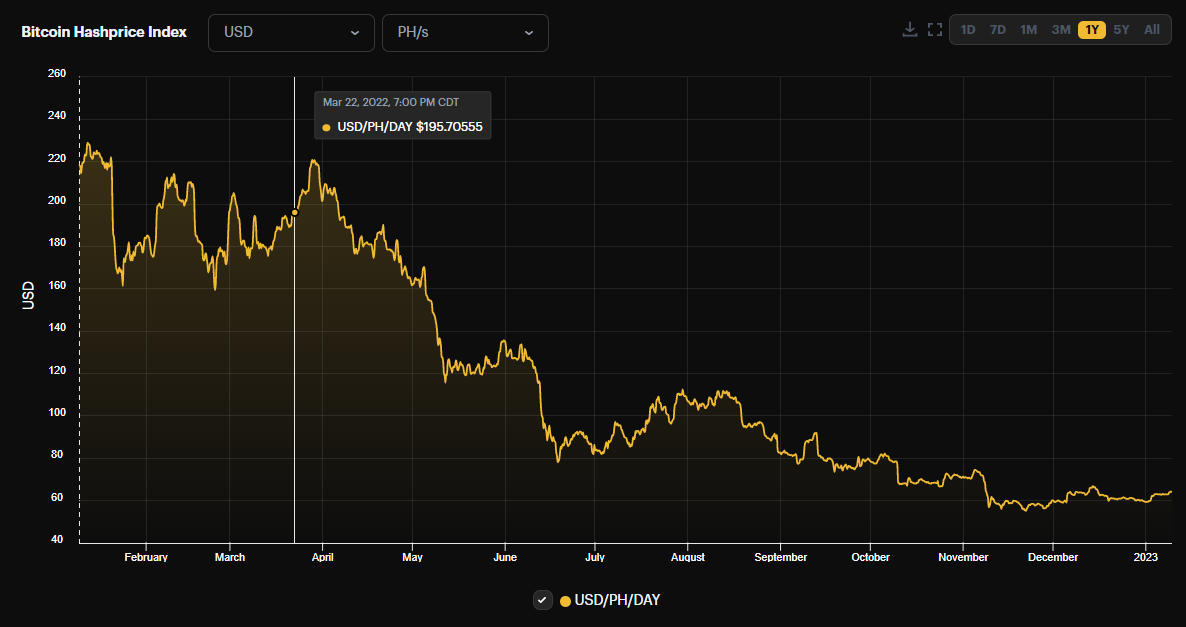

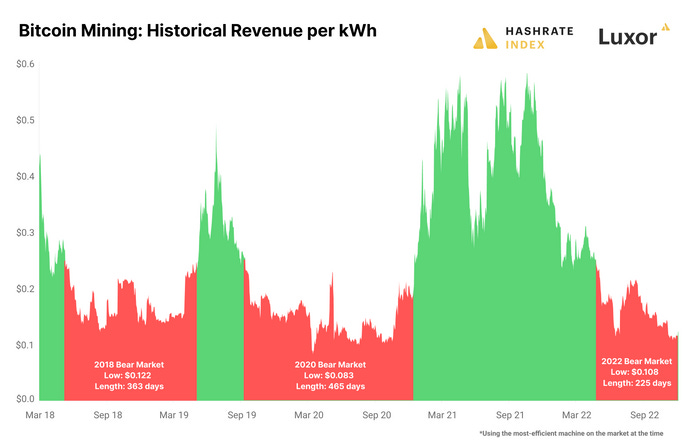

We can turn to a metric called hashprice to get a better idea about how hard these companies were hit. Hashprice represents the revenue that miners can expect for each unit of computational power it provides, measured in hashes/second. Hashprice peaked in the beginning of 2022 at just over $220/PH/Day. It has since plummeted to less than $60 for the same amount of power.

In addition to falling bitcoin prices, Miner’s expected revenue was also negatively affected by an increase in the total hashrate powering the Bitcoin Network. So not only was the numerator decreasing, the denominator was also simultaneously increasing. A catastrophic combination when coupled with the outsized leverage being taken was the lethal blow for even the largest bitcoin miner.

Historically, hashrate is inversely correlated to the bitcoin price. One of the reasons for this is because miners get greedy in bull markets and take on excessive leverage to purchase additional ASIC machines and space to plug them in. Because of pandemic induced supply-chain shocks that have yet to improve, a large number of ASICs that were ordered at the end of 2021 weren’t delivered and plugged in until Q4 of last year.

The last two years blessed us with an excellent case study on bitcoin mining's exceptionally cyclical nature. If this bear market is anything like it's brother in 2018, we may be in for a much longer wait for miner's profitability to turn around considering the bear market between 2018-2020 lasted over 800 days.

If you want to learn more about how this current bitcoin bear market could affect miners compared to previous ones, I'd recommend checking out this article by the team over at Luxor.

In it for the tech

At first thought, it's kind of weird to hear that "improvements" can be made to a form of money as there certainly have not been to the dollar over the last decade. But the decentralized, digital and open-source nature of bitcoin’s protocol provides anyone the ability to collaborate from anywhere in the world to make it better. There were two major upgrades to Bitcoin that are worth highlighting from last year.

The first was a direct upgrade to the bitcoin protocol itself called Taproot. Taproot improves privacy for individuals and businesses transacting in bitcoin while also reducing the amount of data needed to send transactions. It accomplishes this using something called MAST, which allow smart contracts on bitcoin to only reveal relevant parts of the contract when spending. An added benefit of Taproot is the introduction of Schnorr signatures which allow for signature aggregation. Essentially, instead of several separate signatures being included in the same bitcoin transaction, they can be combined into one, vastly reducing the amount of data that goes into each transaction, resulting in lower fees for users.

Taproot was activated by the necessary 90% of bitcoin miners in the Spring of 2022. Because it is soft-fork, it is backwards compatible. Meaning that people running the bitcoin protocol need not upgrade it to continue using bitcoin. It's just a nice-to-have feature that users can use if they choose to. If you're interested in learning more about what Taproot is and why it's an important upgrade to bitcoin, I recommend this Bitcoin Magazine article.

Lightning Network

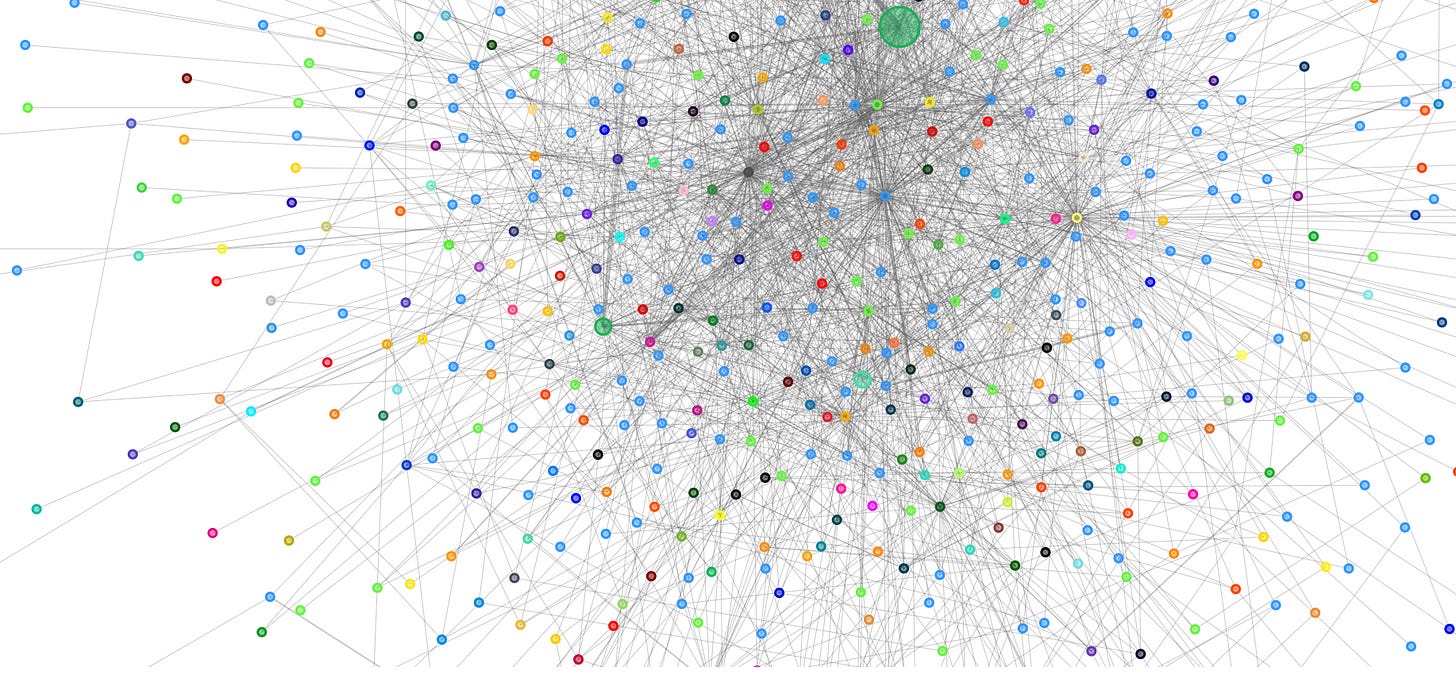

The Lightning Network is bitcoin's scaling solution that makes payments much faster and cheaper. Unlike Taproot, The Lightning Network is not a direct upgrade to the bitcoin protocol. Conversely, it is a layer-two scaling solution, meaning that it is built independently of the Bitcoin network but interacts with it. It’s made up of a system of channels that allows people or companies to move money between one another without needing to use the blockchain to verify the transaction. A visualization of what the network looks like can be seen below.

The cool thing about The Lightning Network is that it is built separately and operates independently of the Bitcoin network. Unlike Taproot, it sits atop the bitcoin network and interacts with it. This allows it to be experimented and battle-tested in many regards, and can be improved upon much faster than the base layer which supports it. This has led to evolve into multiple implementations including numerous lightning wallet and infrastructure providers since it was first introduced in 2016.

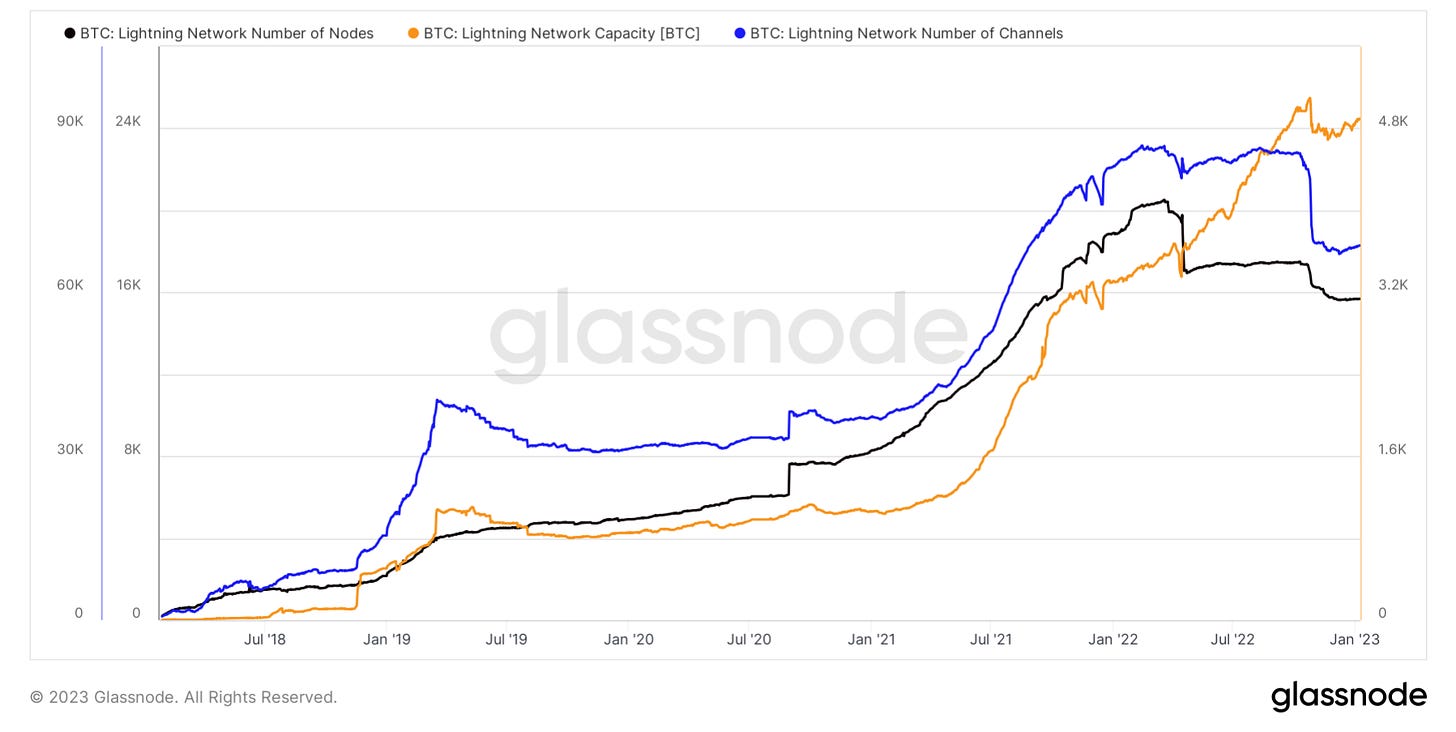

The growth over this year in the lightning network can best be characterized by changes in three key components:

Nodes on the network

Number of open channels on the network, and

Network capacity (the number of bitcoin in channels)

Now if I were to show a YoY table tracking these metrics the numbers wouldn't look so good - and they're not! But the fact of the matter is that this experimental improvement to bitcoin has grown a lot in just the past five years and continues to add more capacity in bitcoin to its system. In doing so, The Lightning Network has built a robust network of implementations and infrastructure to help it scale that way it has.

And based on it's correlation with the bitcoin price, I think it's safe to assume that it will continue to do so and is worth paying attention toward.

If you're interested in learning more about The Lightning Network I recommend River Financial's write-up on the topic. The site 1ML is also a great resource for tracking the growth in real-time.

There are many more developments that took place over the course of 2022. A few honorable mentions include:

Taro - enables the issuance of theoretically any kind of asset on the Bitcoin blockchain, announced by Lightning Labs at the Bitcoin Conference in Miami

FediMints - allows groups to engage in collaborative custody models using Chaumian mints to cryptographically maintain privacy between the individuals of a group while also allowing them to share custody of the entire group’s bitcoin

Value-for-Value - a new approach to content publishing where the creator receives value after the “customer” enjoys the content, once again, through the Lightning Network

Conclusion

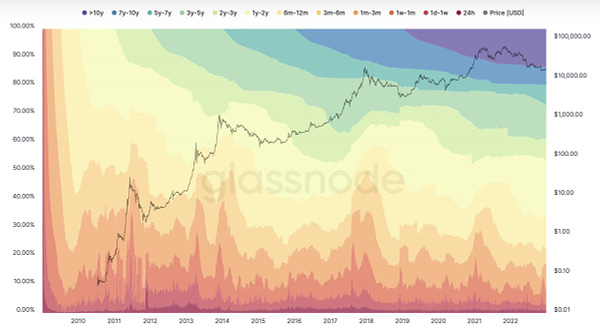

Finally, I’d be remiss if I didn’t share my favorite chart in bitcoin - the HODL waves.

HODL waves shows us the relative age distribution of all circulating bitcoin, based on how long they’ve been held without moving. The percentage of bitcoin that have been held for over one year without moving is at an all-time high and is now over 70%. The reason I’m so bullish about this stat is because these 70% of bitcoin holders are holding the line with an unwavering commitment to hold at these price levels, many of which bought near the top in Q1 of last year. Each wave of adoption brings with it a new group of long-term bitcoins and a new floor. This rising tide lifts everyone.

A Global effort

We take the privilege of an efficient banking system for granted in the United States. In 2023, I project bitcoin adoption will continue to advance in places that need it most like South America, particularly El Salvador and Argentina where it has been legalized as tender, and other countries that have no control over their own currency and are puppets to the U.S. dollar.

Africa is home to the most bitcoin users in the world. The first Africa Bitcoin Conference was held in Ghana in December of last year and was unsurprisingly a massive success. I’m looking forward to riding this momentum into the new year and hope you are too!