Dallas Bitcoin Standard | 006 | 804,376

A mild summer selloff and some thoughts on Financial Advisors using bitcoin.

Bitcoin is back on the move!

Unfortunately, this time it’s in the wrong direction.

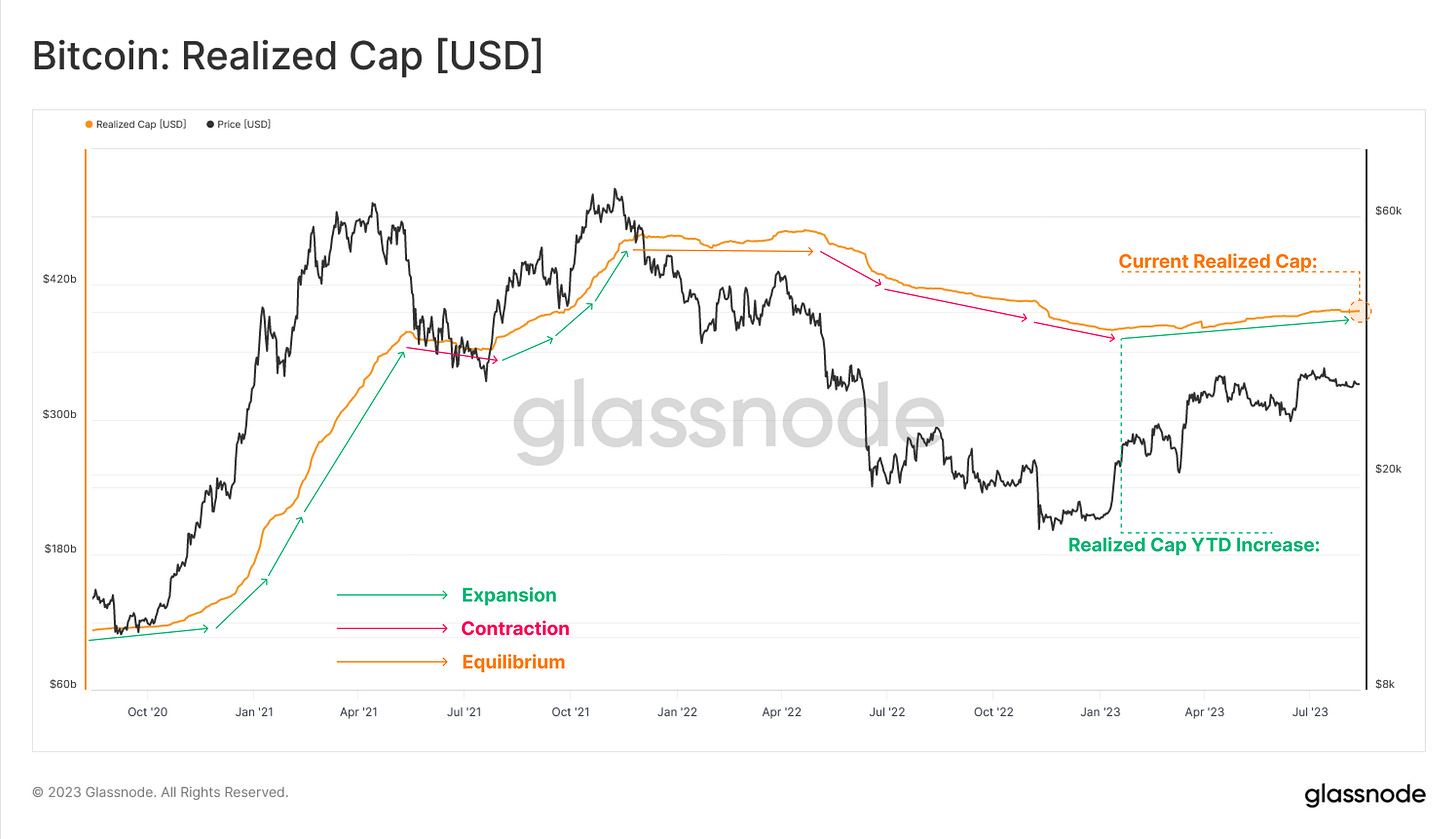

Regardless of whether this mild selloff was spurred by Elon or the SEC’s decision to delay their BlackRock ETF decision another 21 days, a majorly reassuring fact is that bitcoin’s realized cap is still positive YTD. This means that more money is still flowing into bitcoin than out (so far this year to the tune of $16B).

Price action proceeding this move can best be characterized by exhaustion and apathy but frankly it was just boring. The level of volatility we’ve seen over the last few months is the lowest we’ve seen in years and is comparable to only a handful of times in bitcoin’s life. If history is any teacher, this could mean we’re in for a few lackluster months, until bitcoin makes moves back to its all time high set in November of 2021. In my opinion I’d expect this to start happening between the end of the year and next spring as bitcoin approaches it’s fourth halvening event in April.

With that being said, let us rejoice! This reaccumulation phase we’ve been granted could represent a remarkable opportunity to stack sats at low prices headed into the forseeable future. Act accordingly.

The Bitcoin Opportunity for Financial Advisors

It is my fundamental belief that everyone deserves sound money.

While almost everyone would agree with this statement (besides Jamie Dimon), the process of getting people to adopt sound money requires patience. It’s easy for people who have experienced the benefits of holding and transacting in bitcoin to rave on the remarkableness of its fixed supply, virtually instantaneous settlement, real world energy-backed security or store of value properties. But the fact of the matter is that those things won’t mean anything to someone who doesn’t recognize the problem with the form of money they are currently holding.

Until bitcoin gets more widespread adoption as a superior form of currency, it will continue to be viewed as just another asset to include in an investment portfolio. And that’s ok for the time being. This is where I think Financial Advisors have a huge opportunity to make a real difference.

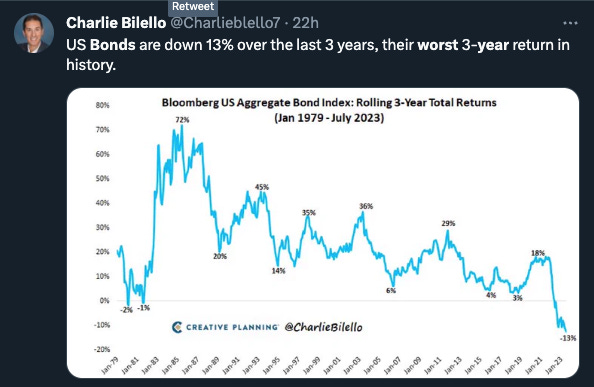

Coming off the heels of the largest and swiftest monetary expansion in history, most Financial Advisors have accepted the fact that Modern Monetary Theory (MMT) and the 60/40 portfolio are dead. They’re looking for alternatives, clients are looking for answers, and bitcoin is looking more and more like the thing you can’t ignore. Each and every day more investors are turning to bitcoin amid a macro backdrop that Stan Drunkenmiller describe as the most uncertain in history.

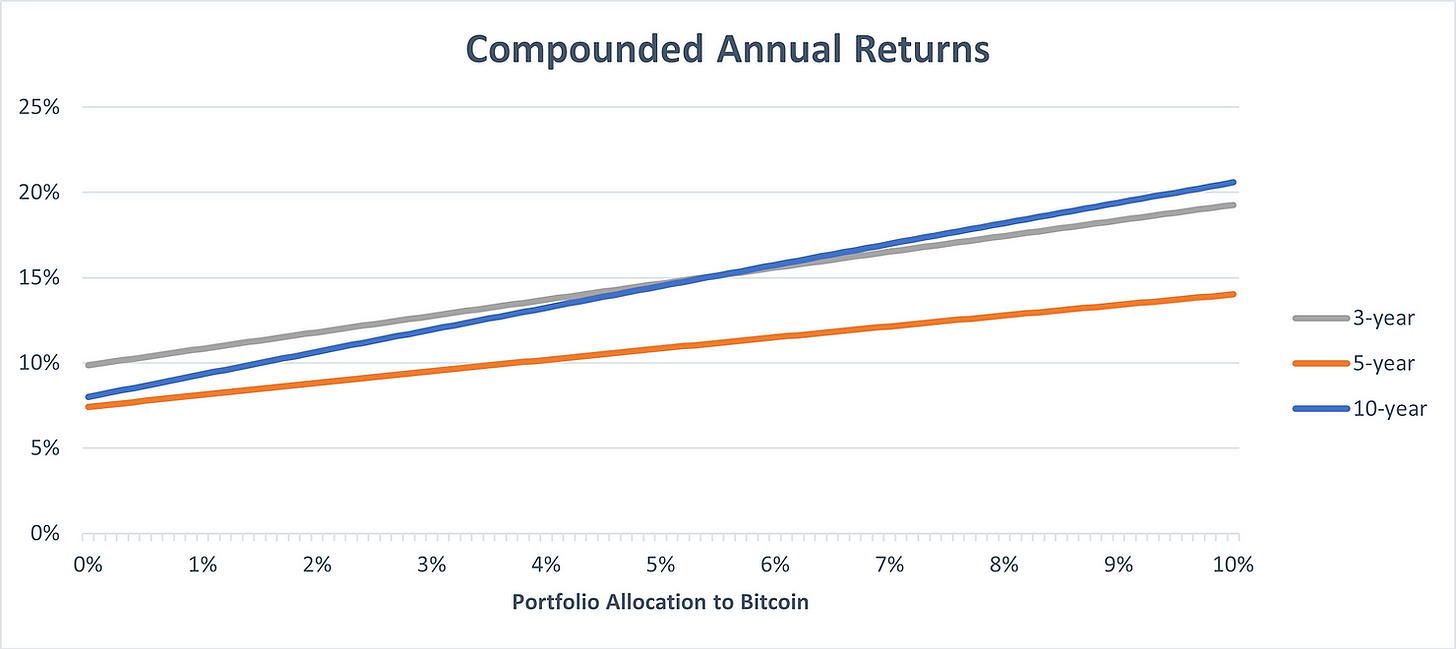

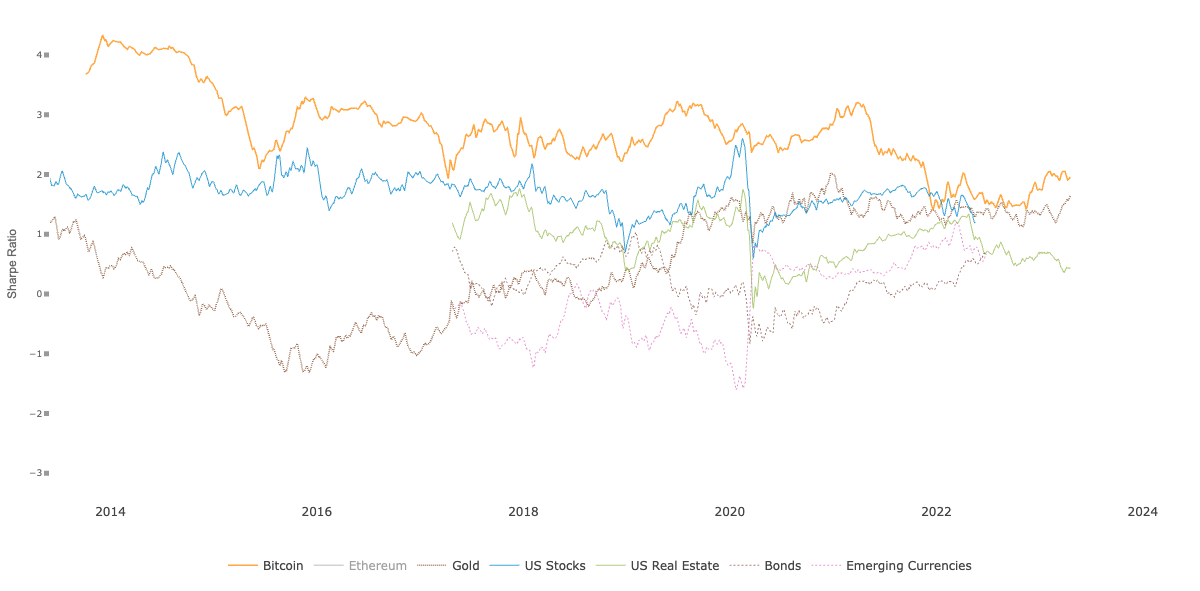

In fact, the case for bitcoin has never been more compelling, not only qualitatively but also quantitatively. Bitcoin’s strong price performance over its 15-year life coupled with its sustained lack of correlation with traditional assets has resulted in even a small allocation substantially increases returns of a diversified portfolio while adding very little risk.

The problem is that the current incentive structure for advisors to recommend bitcoin to their clients is misaligned. As it currently stands, recommending clients buy and hold real bitcoin is all risk and no reward. Instead, they have access to a variety of paper bitcoin alternatives.

Paper bitcoin refers to any form of bitcoin derivative. They are different types of investment vehicles that are designed to get investors exposure to bitcoin by tracking the price of it. Some, like the recently proposed BlackRock ETF, are claims on actual bitcoin that the investor can make to redeem at certain times.

The shortlist of bitcoin alternatives currently available to most advisors looks something like this:

GBTC (closed-end trust potentially soon to be ETF)

Galaxy Digital Investment Fund (mutual fund)

NYDIG Bitcoin Fund (mutual fund)

Microstrategy (pure play stock)

Riot or Marathon (bitcoin mining stocks)

While watching their investments go up in price can make clients feel warm and fuzzy in the short-term, bitcoin derivatives are not a prudent investment move for long-term investors. Because make no mistake about it, none of these options result in investors holding actual bitcoin.

Let’s consider an example of what a few of these options look like in practice to see what I mean.

I know some things about the Galaxy and NYDIG mutual funds because of my time at Morgan Stanley. These funds are for accredited investors only (>$2M in investable assets or >$250k income/year) and charge insane fees (2% placement, 80 basis point trail) for someone else to hold bitcoin for you (typically Fidelity Digital Assets).

Think about that scenario…

You have $500k and want to invest in bitcoin.

You get charged $10,000 up front and then $4k/year in management fees for Fidelity to hold your keys in a straight up honeypot of bitcoin (high security risk).

The $500,000 grows to $2,000,000 in four years and you’re ready to start using it. You go to your Financial Advisor and ask for your bitcoin and he tells you that he can’t send you the bitcoin, and that he has to sell your mutual fund and send you U.S dollars.

Knowing the dollar is hyper-inflating and bitcoin is pristine collateral, you fire up a bitcoin exchange and make a $2,000,000 bitcoin purchase for 0.50bp fee ($10,000), just to have what you could have all along without the sunk costs and tremendous opportunity risk of paying absurd fees and forfeited bitcoin in place of it.

After all is said and done, you could have had $114,000 more of bitcoin if you had just bought it and held it yourself.

The isn’t a dig at Financial Advisors for recommending these products (at least not yet). Education is key and the fact of the matter is the most haven’t considered bitcoin seriously enough to justify spending time learning about it. Plus people are busy, and advisors are people too ya know. They’ve certainly had their work cut out for them since the Great Debasement.

While most advisors would argue that advocating self-custody to their clients is still a pie-in the sky idea, the reality is that most won’t do it because they don’t understand how to do it themselves. As a fiduciary, you look out for your clients best interest ahead of your own. You practice what you preach. So if they haven’t obtained the conviction in self-custody themselves, there’s no way they’d recommend their clients to do so.

Education → Conviction → Practice

Even if they did, the incentives are still misaligned because an advisor has no direct or immediate benefit of having their clients take self-custody. That is, they can’t get paid.

It’s all risk, no reward.

Imagine how excited company’s like Goldman Sachs, Merril Lynch, and JP Morgan are to put an asset with all risk and no reward in their client’s portfolio.

…they’re not.

By the way, when I say no reward I’m referring to the ability to generate revenue based on assets under management. Clearly I believe there are countless ways clients investing in bitcoin is a rewarding strategy for advisors in the medium and long-term, but I’m talking strictly about getting paid. Advisors can get paid on their client’s investment in GBTC or Microstrategy stock (and a heck of a lot more for the mutual funds), but they are not getting paid for helping their clients buy bitcoin and hold their own keys.

But one day, I believe they will be able to.

There are already contingent groups of advisors who are interested in finding new and innovative solutions to this chicken and egg problem. The BTC Financial Advisors Network is a great example of this. An option that members of this group have suggested is using multisig with their clients, where they and their clients split key holding responsibility. This results in their clients retaining ownership over their bitcoin, with also having redundancy and fault-tolerance in place.

As with every industry, wealth management will have to form around bitcoin, not the other way around no matter how badly the incumbent behemoth firms want it to. It’s been fun watching this industry transform its view and involvement with bitcoin over the years, both from the inside and out.

I subscribe to the belief that there will always be value in advice. Just as the rise of robo-advisors will not replace sound financial advice from a real person, neither will bitcoin. In fact, people who preserve their time and energy with bitcoin over the coming decades will need help then more than ever. This is the opportunity that Financial Advisors can capture by keeping an open mind and evolving with the ever-changing financial landscape.

Final thought

BitBlockBoom is this week. Commonly considered “Christmas for bitcoiners.” If you are down in Austin this week, hit me up!

Finally, bitcoin is big Ken energy.

This is a great post and it's my hope that more financial advisors will turn into Bitcoin. Yes the industry still have more work to do before you can benefit financially for putting clients in but being ready when that time comes is something you should do now.