The Dallas Bitcoin Standard | Issue I | 774,668

January jump, all-time highs everywhere, and what the heck is an Ordinal?

Welcome to the inaugural issue of The Dallas Bitcoin Standard, your monthly brief on the most important developments in the bitcoin market!

January saw the largest increase in bitcoin’s price since October of 2021. Despite a tough last year, 2023 is positioned to be an opportune time to be allocating capital to bitcoin, based on its historical four-year cycle, and we’re off to a great start! But what exactly happened in January to cause this? Let’s dig in!

Market Recap

Industry News

Not-so-honorable mention

Rocky’s take

January Market Recap

Bitcoin’s average return in the year following a down year (like 2022) is +62%. We took a huge stride in that direction this month with bitcoin now up 48% since the turn of 2023.

That’s a whole lot of green right there - 21 winning days compared to 10 losing ones. Love to see it.

The two primary drivers of this rally were:

Historically high spot buying, and

A series of short squeezes

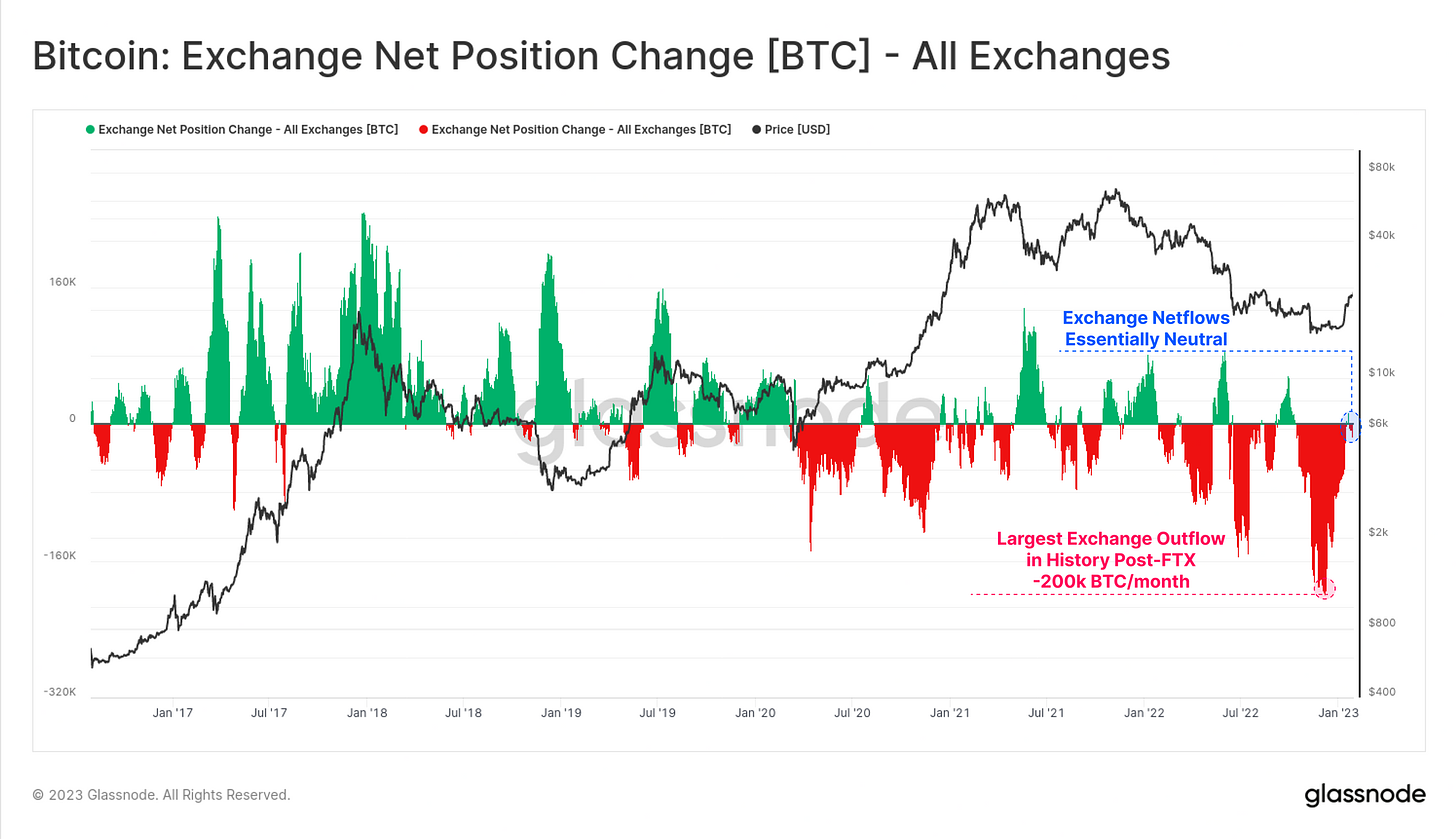

Nearly $500m worth of short futures contracts were liquidated in January. That paved the way for spot buyers to push up the price without much contest. Since the FTX combustion that shook markets around the world in November, we’ve seen the largest exodus from exchanges in bitcoin’s history, with outflows of over 200,000 bitcoin. It’s hard to sell bitcoin that’s not on an exchange!

Although we can’t be certain where these coins are moving to, it isn’t farfetched to say they are mostly being moved to cold storage. Of course this may not always be the case, but considering that nearly 70% of all bitcoin have not moved in over a year (an all-time high), I think the narrative fits. Not Your Keys, Not Your Cheese!

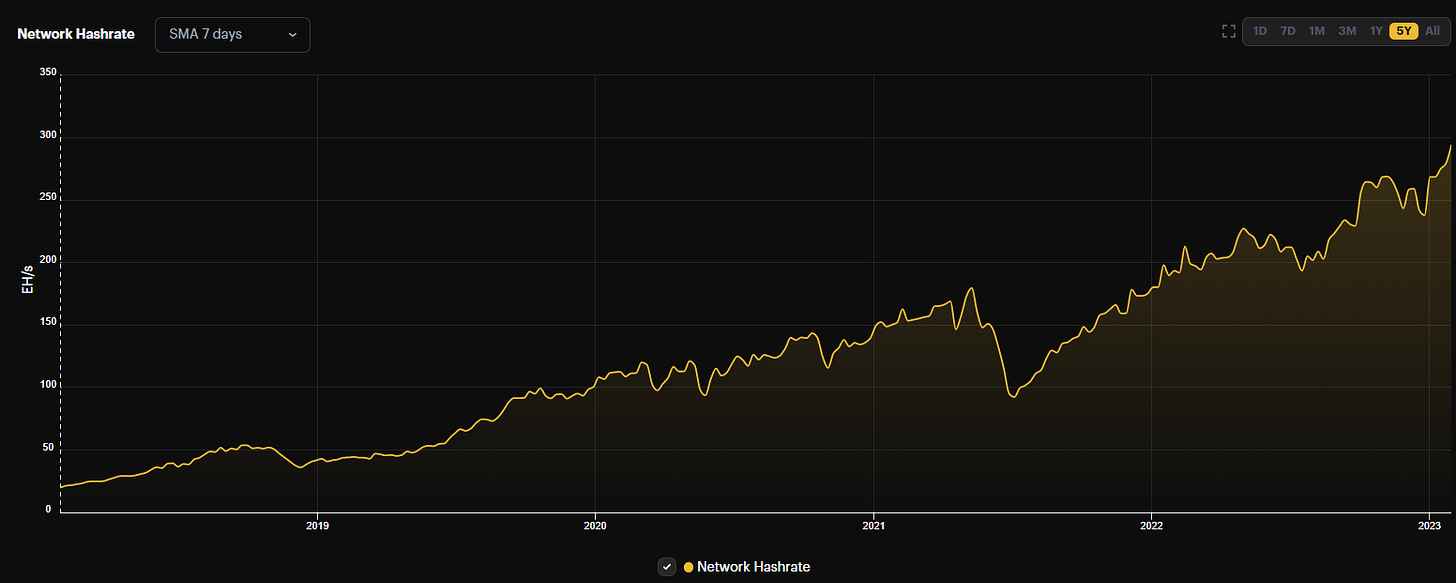

Halfway through the month, Bitcoin underwent a 10.26% upward difficulty adjustment, followed by another 5% hike up last week. This signals more mining machines and, therefore, hashpower in the form of electricity coming onto the network. This week we hit an all-time high in hashrate at 297 Exahashes/second.

An increasing hashrate is a bullish sign because it represents an increased demand for bitcoin through more miners competing for the block subsidy (currently 6.25 bitcoin) by adding blocks to bitcoin’s ledger. Bitcoin’s difficulty adjustment is its killer app that ensures blocks of transactions continue to be added every 10 minutes (on average) no matter how much hashpower comes on or off the network.

So to recap, three all-time highs were hit in January:

hashrate

percentage of bitcoin held for over one year

bitcoin outflows from exchanges

Industry News

Genesis Lending files for Chapter 11 bankruptcy - the latest domino to fall in the aftermath of the failing of centralized lenders throughout 2022 (if you want to learn more about this I cannot recommend my friend Sam’s spectacular breakdown on contagion between Genesis, GBTC, and DCG highly enough. My man brought the receipts!!)

The Texas Work Group on Blockchain Matters released a report to expand the blockchain industry in Texas in compliance with House Bill 1576, passed by the 87th Texas Legislature. The highlights include:

the right to hold your own keys,

severance tax abatement for natural gas that was once flared but is now being consumed on-site

incentives controllable loads like bitcoin mining, and

allowing the state of Texas to purchase bitcoin

Texas A&M University is launching a course on Bitcoin - personally, it comes to no surprise that a school in Texas is leading the charge!

Not-so-honorable mention

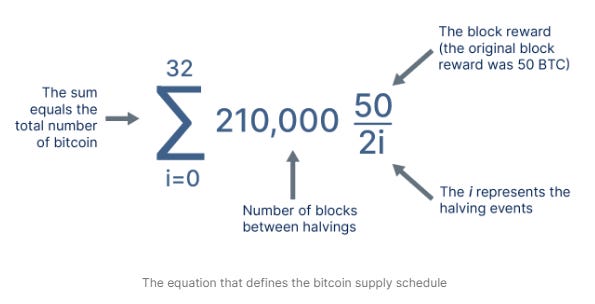

As is tradition, bunch of global elites gathered in Davos this month for their annual demonstration of how disconnected they are from reality. In an interview with the CNBC crew, Jamie Dimon (notorious bitcoin hater) demonstrated his total and complete misunderstanding of bitcoin for the nth time, claiming “hype fraud,” and “pet rock,” championing blockchain over bitcoin, and questioning whether bitcoin’s supply is actually fixed at 21 million, all in under 90 seconds. Sheesh. Unfortunately, I lost brain cells watching this, so now you do too.

It should come to no surprise that Jamie is bitcoin’s staunchest opponent. He is one of the few people who pull the strings of the current financial system built on fiat money; the very system that Bitcoin undermines. Bitcoin is Jamie’s worst nightmare. No matter how many dollars or how much power Jamie has or will ever have, he cannot control bitcoin anymore than you or I can. Bitcoin has rules, not rulers. Bitcoin is money by the people, for the people. Bitcoin is honest. And that’s why he hates it.

And yes Mr. Dimon, we can be certain that bitcoin’s supply will never exceed 21 million. It’s math, and it’s available for anyone to see:

Rocky’s take:

Thank you so much for checking out my first issue of The Dallas Bitcoin Standard. I genuinely appreciate your time. If you have any feedback of ways that I can make this publication better I would absolutely love to hear it!

Around the holidays, I took some time to write personal notes to many of my clients here in Dallas. In them, I emphasized that although 2022 was a brutal year in the bitcoin market (and that’s sugarcoating it), we have a lot to look forward to in the year ahead. I couldn’t be more sure of this, and I’m humbled that I have the privilege to help advance bitcoin every single day. I appreciate you being along for the ride with me!

A fun topic I’ve been thrust into of late are Ordinals. Simply put, ordinals serialize sats (short for “satoshis,” the smallest unit of a bitcoin) so that they can be individually tracked. Personally, I’m a fan of bitcoin’s fungibility, I believe that will be an important component in its ascension as a Global Reserve Currency. Either way, ordinal theorists can decide for themselves which sats are rare and desirable, and bitcoin will continue producing blocks every 10 minutes the same as its always done.

During the Christmas break I also got around to setting up my Nostr account. Nostr stands for Notes and Other Stuff Transmitted by Relays, and is like a decentralized version of Twitter Follow me if you’ve got yours going!

npub1w6gfhjs94ca36j64kh9nn8wq07wykc4xegha4nsg4tehqf9uja7q0qtyf6

To learn more about what Nostr is and how to use it, look no further than this guide.

That’s it for this month! To 21 million and never beyond!

Join us in-person if you’re in Dallas!

https://www.meetup.com/dallas-bitcoin-meetup-group/