Dallas Bitcoin Standard | 005 | 796,568

Bitcoin fundamentals have never been stronger and a BlackRock ETF

Howdy team!

I’ve received a lot of messages recently about the BlackRock ETP filing, so I thought it was time to share a brief note with some thoughts. Let me know what you think in the comments section below!

One of my earliest memories of bitcoin in the media was watching the Winklevoss twins speak before Congress on the benefits of a spot bitcoin ETF in 2017. Since then, nearly 30 attempts at such a product have been reviewed and rejected by the SEC. Below is a short-list of some of the applicants that have been denied thus far:

Ark

Fidelity / Wise Origin

First Trust / SkyBridge

Global X

Grayscale

Galaxy Digital

NYDIG / Stone Ridge

Valkyrie

VanEk

Time and time again, the SEC has denounced the idea of a spot bitcoin exchange traded product and its reasoning is twofold. First, they view the bitcoin market as heavily manipulated, and would require an exchange partner regulated like any major U.S. exchange (NYSE, Nasdaq, CME). Second, every application thus far has lacked an acceptable surveillance agreement. Enter BlackRock.

When BlackRock filed its application on June 15th, I was surprised to learn that it is the first to:

be structured as a Grantor-Trust (single-commodity; open-end fund), and

include a surveillance agreement.

While the grantor trust model carries many benefits for investors when compared to something like Grayscale’s GBTC Trust, as outlined in Jesse Myer’s recent breakdown, it is not innovative by any stretch of the imagination. State Street’s GLD is the most suitable candidate for comparison, and it’s been around since 2004.

What could potentially separate BlackRock from the fighters who have come before it, other than having tentacles in pretty much every financial and government institution in the world, is its addition of a surveillance agreement to mitigate market manipulation. {Queue Gary Gensler drooling}

Though this ETF is not the same as owning real bitcoin, it is better than closed-end trust paper bitcoin like GBTC. Because, for each basket of iShares Bitcoin ETF shares that are sold BlackRock must purchase that amount of real UTXOs on the open market.

This is why I think the market responded so positively to the news. Also because…it’s BlackRock. Zooming out, it’s pretty wild that the world’s largest asset manager is signaling to the market that bitcoin isn’t going anywhere for the foreseeable future. We’ve come a long way since the Winklevoss twins!

In addition to bitcoin not getting banned by the Government anytime soon, a few other effects I see a BlackRock bitcoin spot ETF having include:

Colossal capital inflows from large institutions, pension funds, and retirement accounts (I’d guess 10’s to 100’s of billions of $ just in the first year alone)

Provides cover for companies that want to add bitcoin to their balance sheet

Mainstream Wealth Management firms incorporate bitcoin into their investment strategy for their clients

Back in my days at Morgan Stanley, talking about bitcoin with clients was generally frowned upon. Personal views aside, advisors had no incentive to, because the risk with compliance outweighed the potential returns for their clients (SAD). However, no advisor has ever gotten fired for putting their client in a BlackRock ETF.

Assuming the market sees what I’m seeing, it priced in this potential reality quickly -shooting up ~15% to over $31k in a matter of days, despite the two largest cryptocurrency exchanges by volume being sued by the SEC just a week prior.

It’s headlines like these dictate price in bear markets but are shaken off quickly in bull markets. The reaction we’ve seen from bitcoin over this month is undoubtedly bull market type of activity.

Ultimately, I think whether or not the BlackRock ETF gets approved depends largely on how Coinbase responds to its lawsuit with the SEC, considering it is listed as the custodian of all bitcoin held by the trust in the ETF filing. Brian Armstrong and company sit in an extremely precarious position, approaching a penultimate decision that will surely set its trajectory for years to come.

Although they were caught 100 yards offsides operating as an unregistered broker dealer and listing unregistered securities, BlackRock has thrown Coinbase a life preserver (not my best analogy combo). While the possibilities here are endless, there are two clear paths that Coinbase can choose from:

Coinbase hops on USS BlackRock - delisting every other crypto asset from its platform other than bitcoin, becoming a SEC regulated exchange, and becoming the sole bitcoin custodian for capital inflows into the iShares Bitcoin ETF and a subsidiary to BlackRock, or

Coinbase fights the SEC in court - in an attempt to navigate open, shark-invested waters and swim to shore, Coinbase will defend its shitcoin business model in what could be a lengthy and drawn out litigation battle depending on how hard the SEC decides to come down on the broader cryptocurrency market. This would surely result in a rejection of the BlackRock’s ETF and a legal battle that could take years.

Meanwhile, Binance is probably screwed…

Regardless of how this all goes down, I’m going to continue preaching the principles of self-custody. My fear is that a combination of potentially trillions of dollars worth of pent up demand with a fixed and increasingly scarce supply of bitcoin results in even BlackRock being unable to fulfill their obligations to shareholders. And the idea that an 80 year old couple banking on their nest egg of “bitcoin” will learn the adage “Not your keys, not your bitcoin” the hard way is heartbreaking.

Because at the end of the day, bitcoin is a system of ones and zeros. It is a base layer of truth that we can build the future financial system on. It is a fixed set of easy to follow yet costly to change rules that allow the coordination of human action. It is a fixed monetary policy of 21 million units, with ~1.8 million left to be issued. And buying the BlackRock ETP doesn’t get you any of those units, it just gets BlackRock more of them. Fortunately, no matter how many bitcoin or what percentage of the overall supply BlackRock ends up holding, it wouldn’t have any more influence over the rules or how they are enforced than you or I.

…but if and when it is approved I think we see blue sky bitcoin not only by the next halving but even before the end of the year.

Had to end it on a nice note!

Bitcoin fundamentals have never been stronger

Few things I want to hit on here.

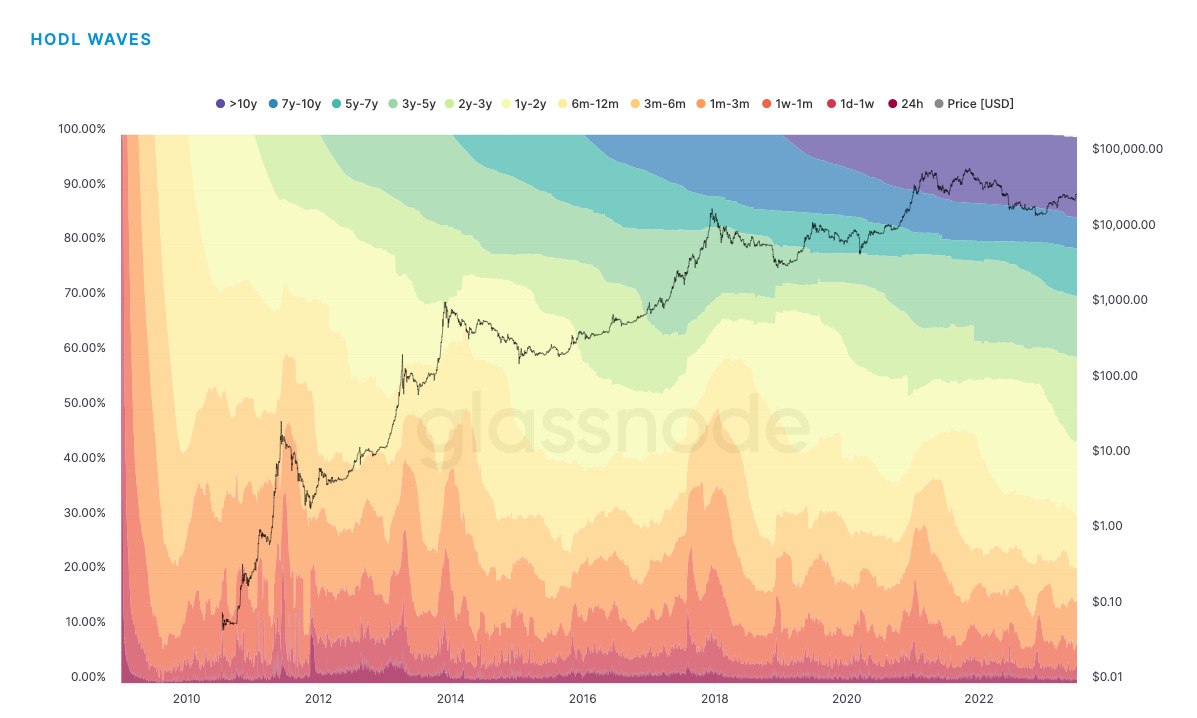

First is the amount of bitcoin that hasn’t moved in over a year. According to the latest HODL waves, 69.35% of all bitcoin have stayed put in that time. It’s incredibly bullish that, even with the recent pump to $30k, most bitcoin investors aren’t taking quick gains. Instead, it looks like they’re in it for the long haul.

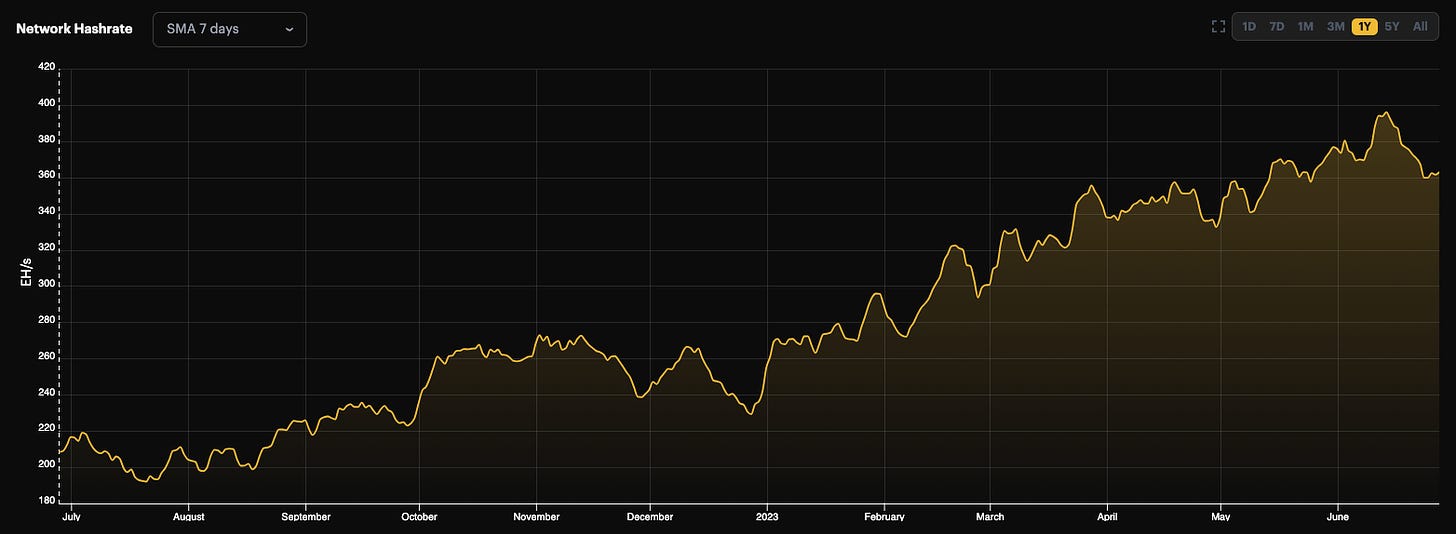

Bitcoin Network hashrate marched to another all-time high in June, reaching nearly 400 Exahashes/second.

It makes a lot of sense why the amount of computing power competing for bitcoin blocks has dipped since these highs. Summer came in HOT this year and has put major stress on energy grids, especially in Texas where a majority of bitcoin miners are located. In an effort to stabilize the grid, bitcoin miners have been powering down their machines and have been redirecting that power to support their local communities. Bitcoin and energy symbiosis in action!

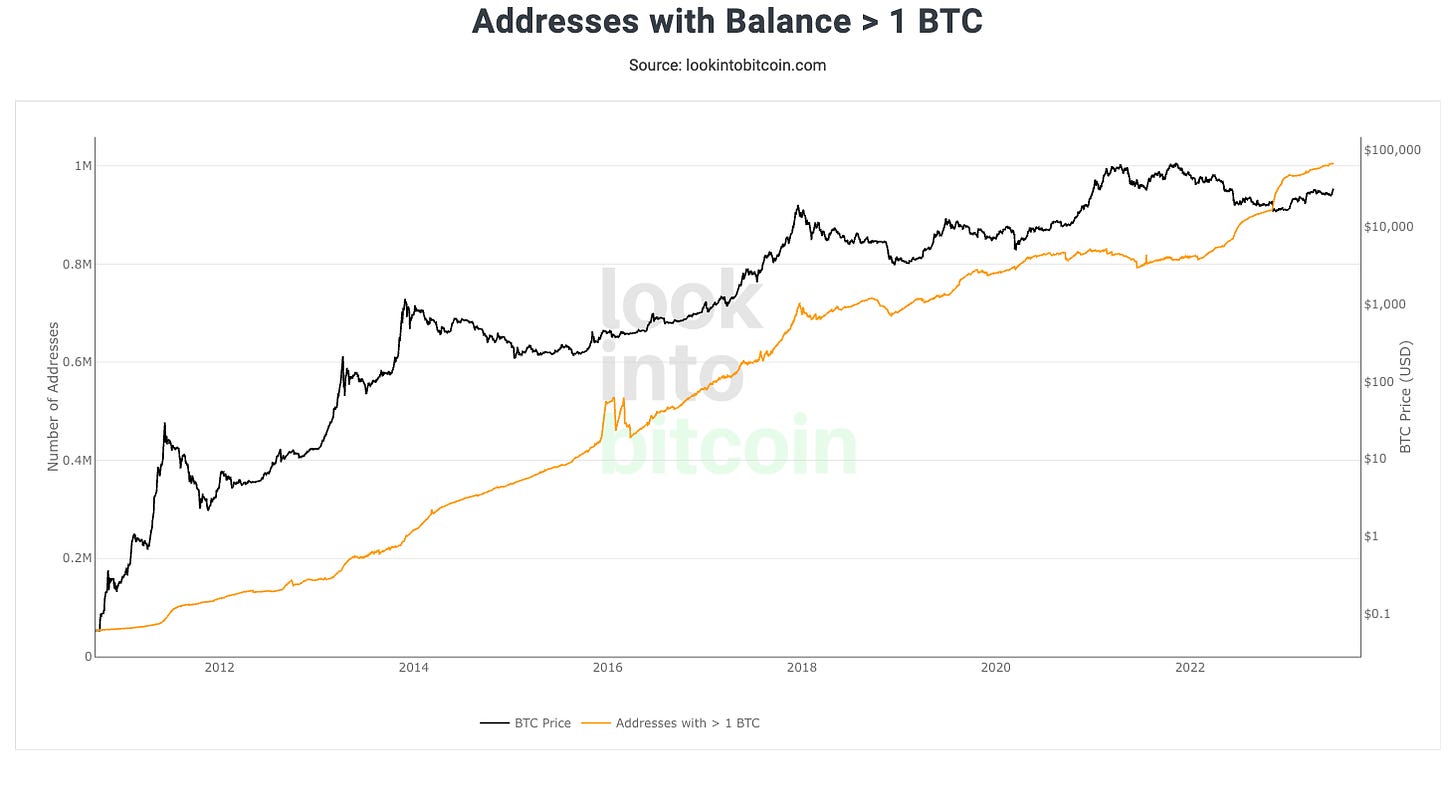

Finally, the number of unique bitcoin addresses that contain >1 bitcoin has never been higher.

Objectively, this could be for a number of different reasons. But it is fair to insinuate that more people have made their first allocation to bitcoin due to my 2022 year-end review and investment outlook :)

I’m going to be doing a lot more writing this summer and am hoping to get more market updates out than the once/month cadence I’ve been on. Of course, this depends on what’s going on in the market but something tells me that things are only going to get more exciting leading up to the halving next March, not less.

Thanks for your time! To 21 million, but never beyond!

Rocky

Another great write up Rocky. It appears Coinbase is going to take option #2 and fight to keep the Shitcoins :) and within seconds of you releasing this the SEC comes out and says the Bitcoin ETF fillings are "inadequate?" Wait what?! Will BlackRock go 575-2? Time will tell.